Our Solutions

Our digital lending solution enables instant, automated, and collateral-free loans through a fully digital process. It offers an end-to-end lending solution powered by a Decision Analytics System to assess credit worthiness and a Loan Management System that automates the entire lending cycle.

The Decision Analytics System incorporates advanced credit scoring models and risk assessment algorithms to evaluate borrower creditworthiness and minimize lending risks. The analytics system identifies eligible customers based on pre-set customizable criteria, resulting in reduced risk of defaults. The enhanced accuracy of our system ensures confident expansion of your lending portfolio with exceptional risk management.

Our digital lending solution Leverages advanced analytics and AI-powered credit scoring for real-time decision-making. This enables instant approval and disbursal of loans for eligible customers as they can apply for and receive loans in real-time through mobile devices, eliminating lengthy approval processes.

We offer a solution that automates the entire lending lifecycle, from customer eligibility to loan application and approval to disbursement and repayment tracking. This reduces manual intervention and streamlines operations, leading to increased efficiency and reduced costs.

By providing automated instant loans our partners tap into new revenue streams, catering to the growing demands for quick credit options and thereby serving a wider underserved demographic. This means increased loan portfolios and long-term profitability. We help achieve this by bringing operational costs to near zero, allowing scalability while maintaining control over fine-tunings and customizations.

Use Case

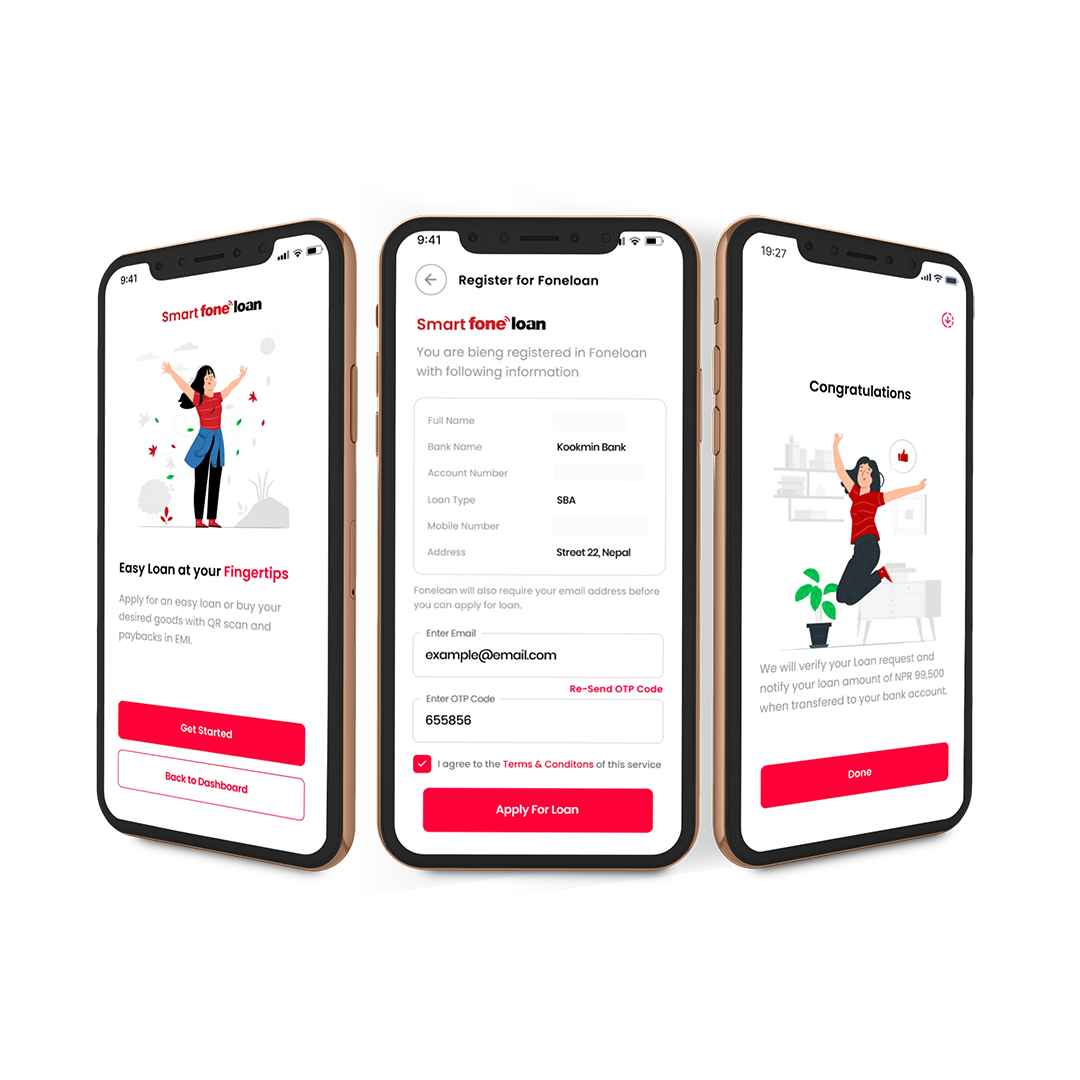

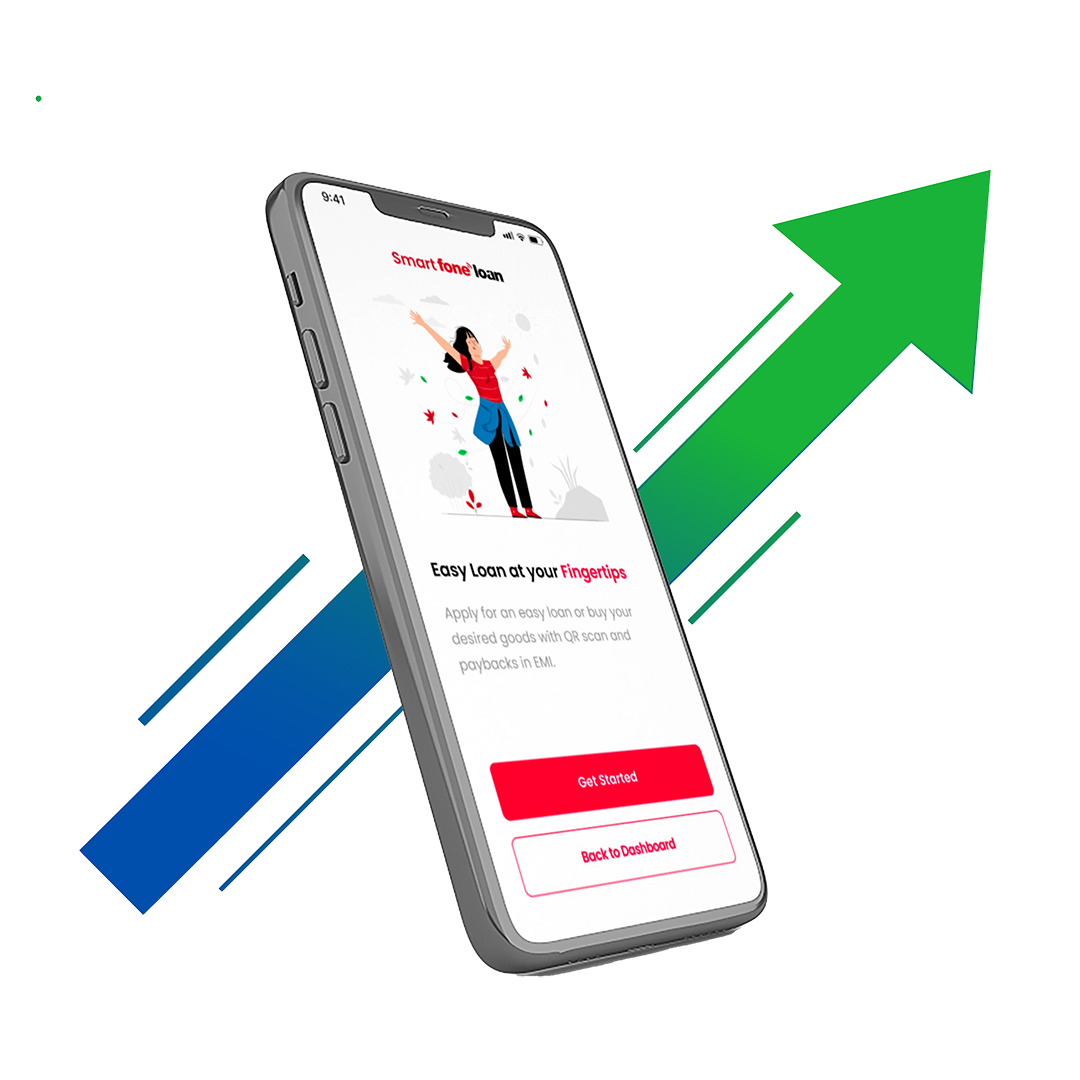

Foneloan is a next-gen digital lending solution that empowers banks to provide quick, hassle-free loans directly through customers' mobile devices. Foneloan makes borrowing convenient, secure, and efficient. With Foneloan, borrowing is seamless, instant, and accessible, transforming traditional lending processes into a fully digital experience.

100K+

Users

320K+

Loans Distributed

$57M+

Loan Volume