Our Solutions

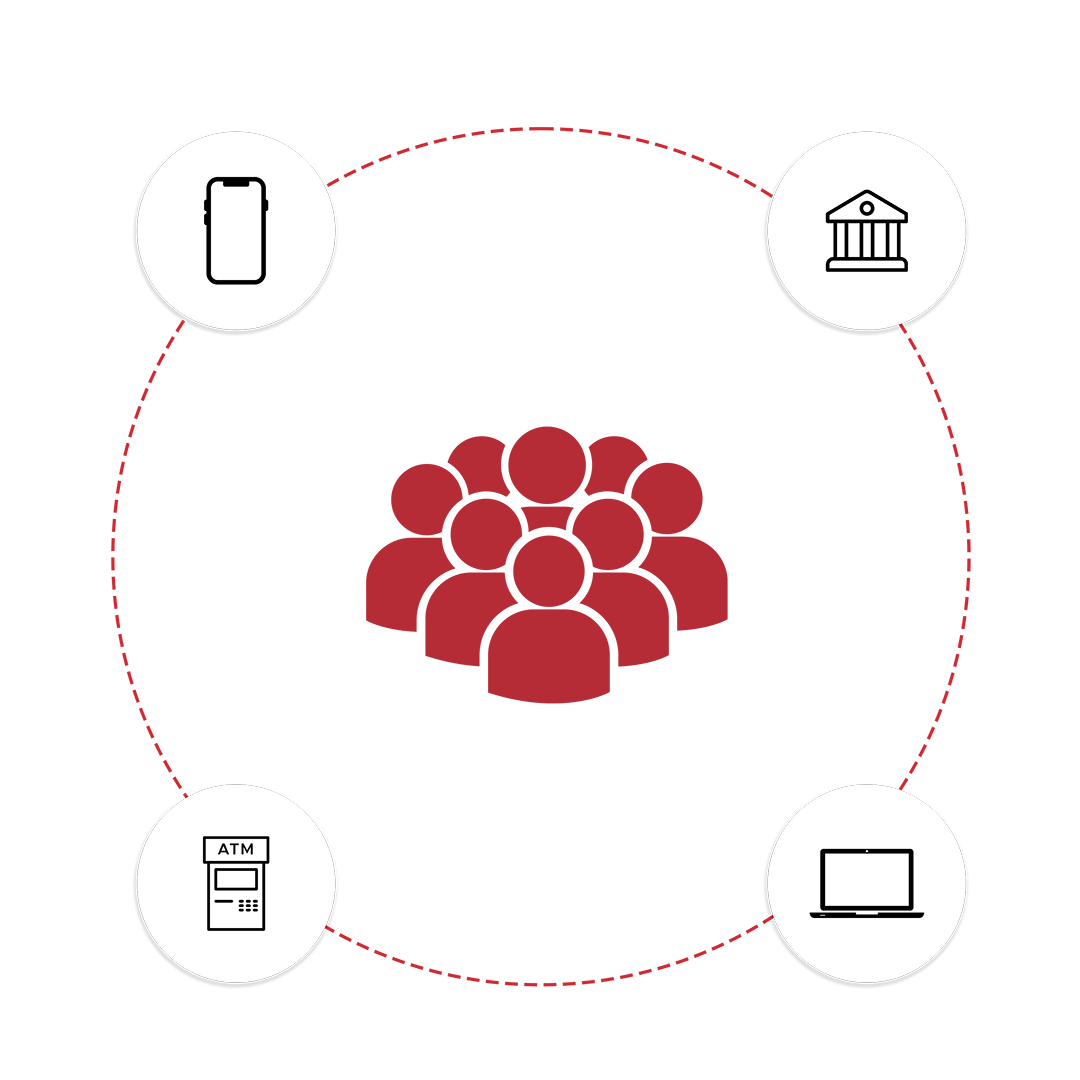

By seamlessly integrating mobile, web and branch banking, our Omnichannel Banking solution offers an all-in-one digital suite that acts as a unified system, connecting all banking and third-party services across platforms.

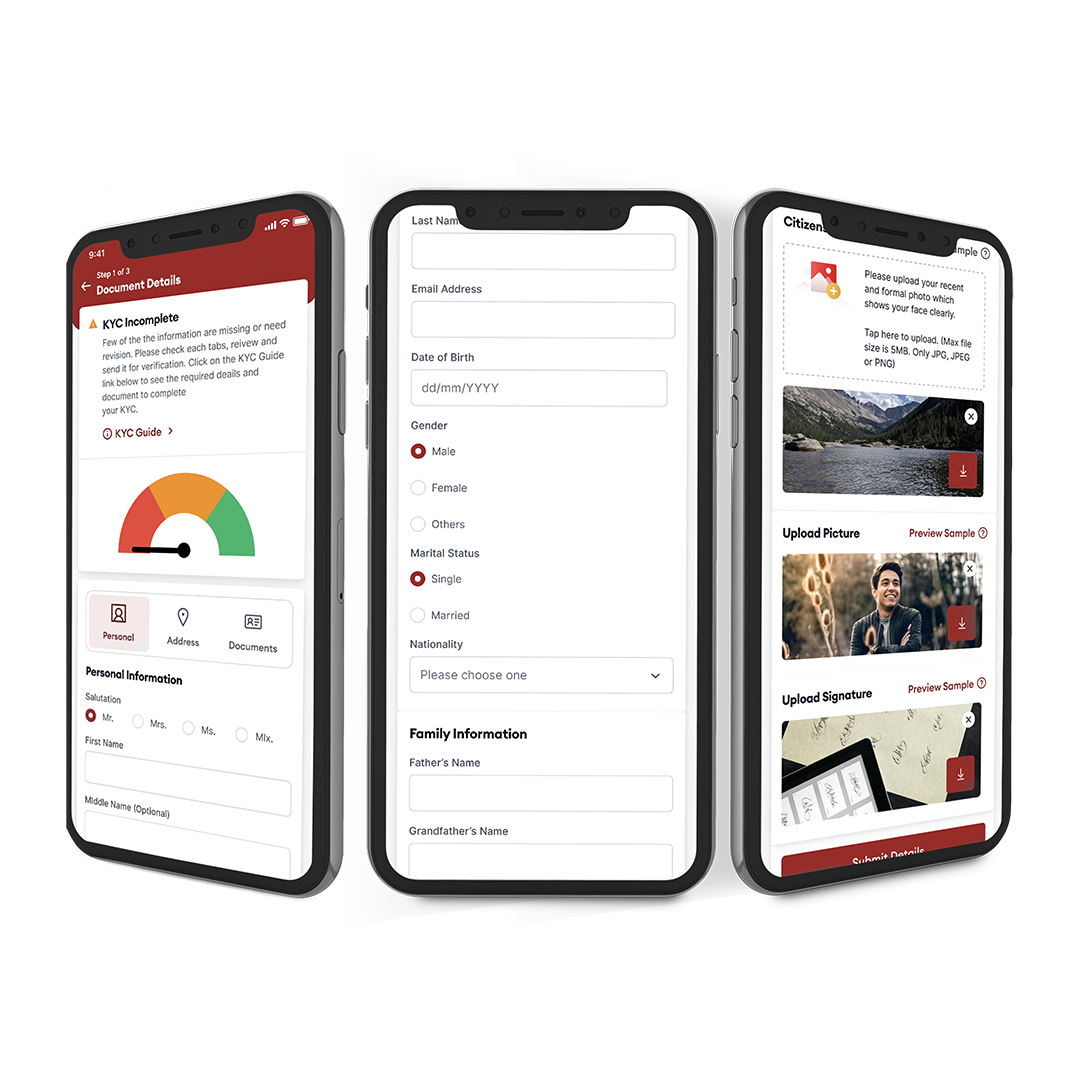

Simplify the account opening process through mobile-friendly intuitive interfaces that eliminate drop-rates. Seamless integration with real-time KYC checks and automated document verification ensures a quick and secure onboarding journey.

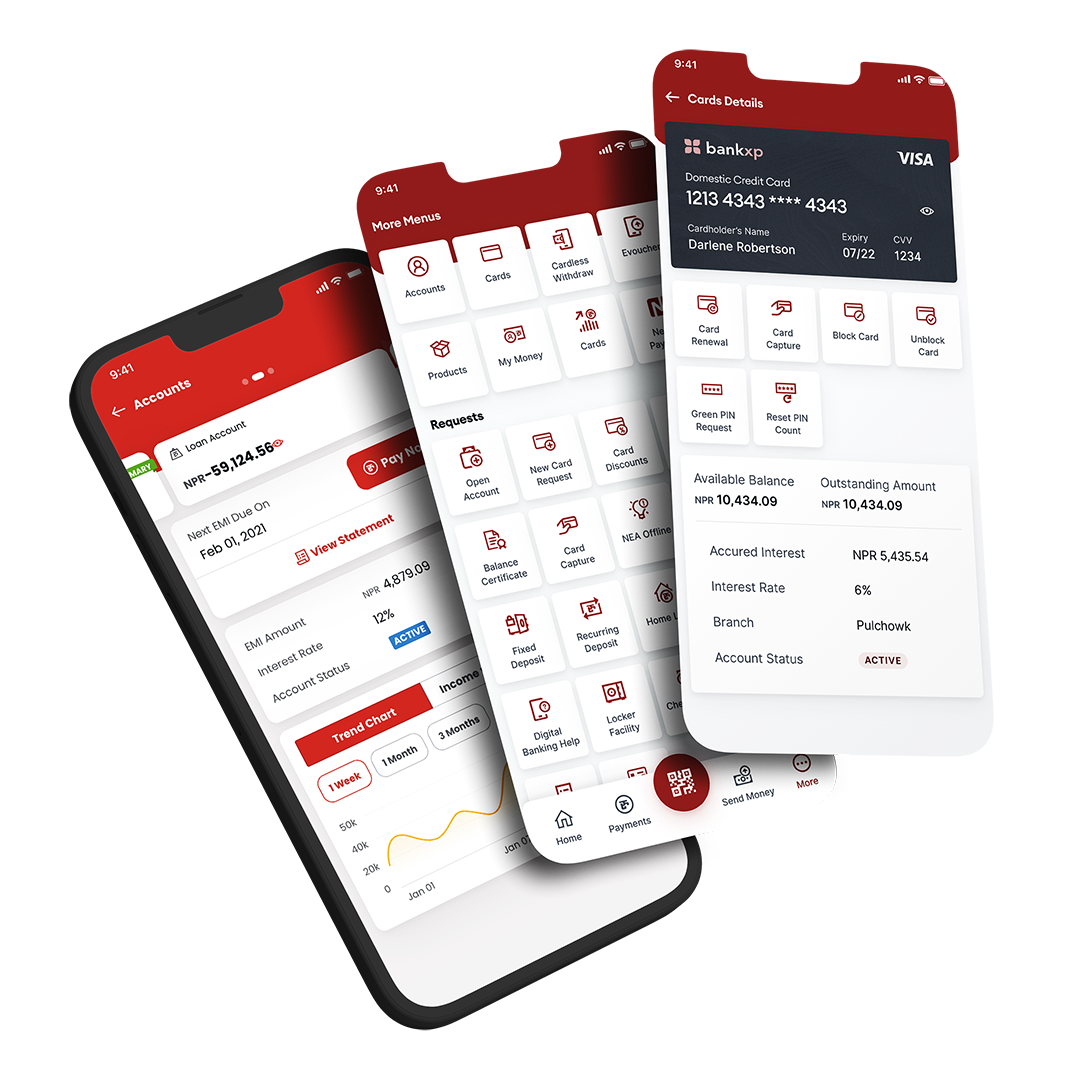

Empower your customers with 24/7 digital banking, enabling them to manage finances, transfer funds, and make payments conveniently through a mobile app or a web browser. Features include account management, payments, transfers, loan applications/tracking, card integrations, digital remittance and many more.

Consistent user experiences across all digital touchpoints, regardless of the device or platform, allows for effective customer engagement and adoption. The single sign-on feature allows customers to use the same login credentials for app as well as browser access. Event-driven microservices architecture ensures that all user interactions are updated across platforms instantaneously.

State-of-the-art security measures such as SMS verification, mobile-to-web QR login, 2FA, Encryption and password policies ensure that customers are always protected. Strict security protocols such as vulnerability scans, automated patch management and intrusion detection help us detect and respond to security threats in real-time.

Using advanced analytics and event-based triggers, our system sends real-time personalized notifications and offers to customers via their preferred channels. This can include alerts about new features, reminders for payments, or promotions that are relevant to their recent interactions, ensuring timely and relevant engagement and retention.

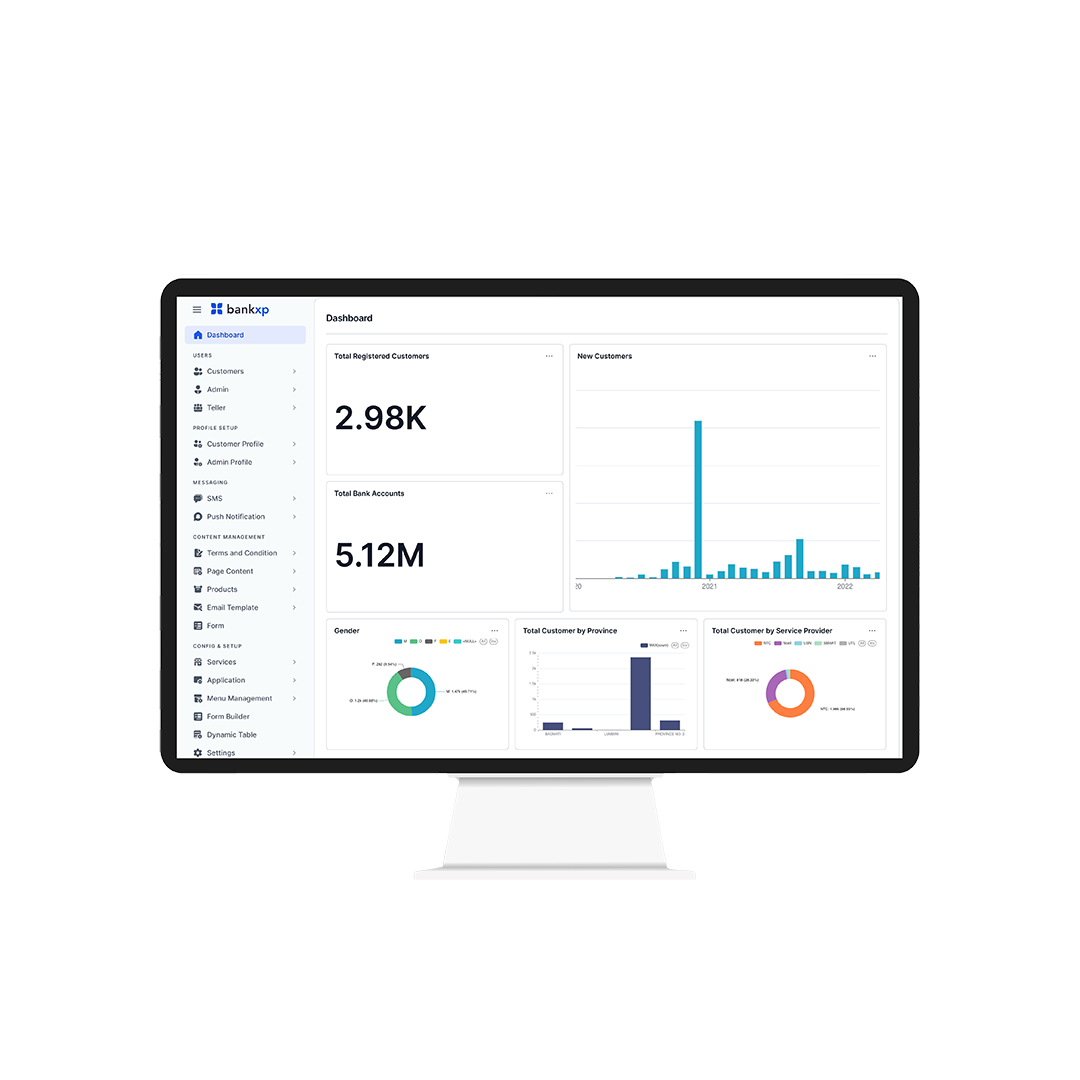

Our Digital Back-Office is capable of handling every aspect of a customer’s banking experience, from customer management to engagement to cross-selling, through one centralized management system. This key element is the cornerstone of our proven ability to deliver cost reductions and efficiency enhancements to our partners.

Use Case

BankXP, our omnichannel banking platform, is trusted by 50+ banks, enabling them to deliver a complete and consistent digital banking experience to 23M+ customers through self-service and assisted options.

50+

Banks

23M+

Customers

2.2M+

Transactions Daily

300%

Reduction in Branch Footfall