Our Solutions

Our Neobanking solution, a cutting-edge Banking as a Service (BaaS) platform, enables banks to foster innovation by reducing operational complexities and accelerating time-to-market through fully digital, customer-centric banking experiences.

Our digital onboarding process facilitated by eKYC provides an effortless and swift account creation experience. With document capture and OCR functions, our solution offers a hassle-free and intuitive onboarding experience through a user-friendly interface.

Integrated AI features future-proof the entire banking journey by constantly adapting and improving to provide insightful customer-centric and personalized experiences. Our AI-enabled recommendations engine analyzes customer interactions, preferences and goals, thereby providing customers with tailored suggestions to make informed decisions. By using cutting edge AI technology including NLP and Gen AI, our chatbot provides human-like financial insights based on customer queries and app behavior.

Our microservice architecture runs by unique processes and communicates to serve specific business goals. Easy scalability of each component allows high performance and reliability, even during peak loads maintaining a flawless user experience. With effortless integration and exceptional scalability, banks can leverage our platform to meet their growing business demands.

We offer a complete digital banking solution stack from core banking to card management while being customizable and scalable. Our OPEX business model means that initial investments are minimal with opportunities to outsource IT services, allowing you to focus on core business functions. Our agile deployment capabilities help our partners to quickly adapt and evolve with market demands.

Use Case

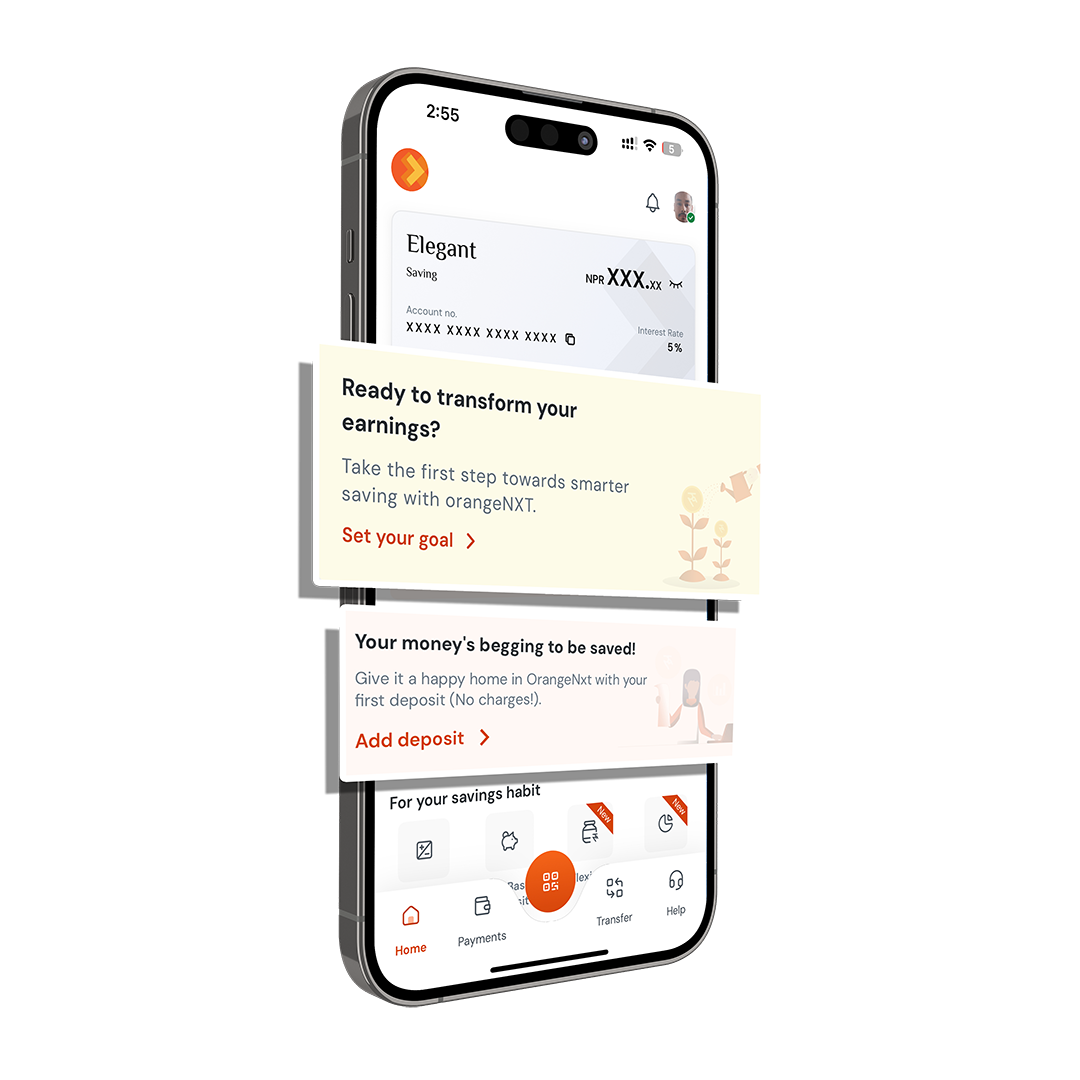

OrangeNXT is a digital-only banking service, the first of its kind in Nepal. Designed as a next-gen digital banking platform, it caters to the digital native by providing features like digital account opening, goal based savings and personal finance management.

100%

Digital Onboarding

100%

Digital Operations