With the theme "Banking Tomorrow and Beyond", Bankers’ Meetup 2025 served as a space for industry leaders, innovators, and visionaries to explore the future of the banking sector. The event featured a range of insightful presentations and product showcases addressing the evolving landscape of financial services where FoneNXT presented the approach to digital customer onboarding for financial institutions. Their presentation highlighted how modern onboarding solutions can transform the customer journey—streamlining account setup, improving verification processes, and enhancing user experience.

Banking in Nepal has traditionally been a time consuming process. Whether it’s opening a bank account or managing heavy paper workflows, the experience often has been difficult for all parties involved – sometimes due to challenges with accessibility, other times with growing customer expectations for smoother, faster experiences.

The Challenge With How Things Are

Take a hypothetical individual looking to open a bank account. Say, this person lives 10 kilometers away from the nearest bank branch. To open an account, he needs to make multiple trips—one to submit the documents, another because he forgot to bring a photo, and yet another to collect his bank book and card. And Ram is not alone. Many like him end up relying on cash or digital wallets, simply because traditional banking feels like too much work.

Even in locations where banking services are more accessible, where everything from groceries to gadgets is delivered to your doorstep, why should anyone still stand around in queues to simply open a bank account?

Opening an account shouldn't feel like navigating a maze of paperwork and repeated visits. But for many, that’s exactly what it is. Forms can be confusing. Missing documents cause delays.

Banks, too, face a challenge. Outdated processes slow down customer acquisition and create operational bottlenecks. What’s needed is a system that’s fast, secure, and built for the modern world.

FoneNXT’s Game-Changing Solution

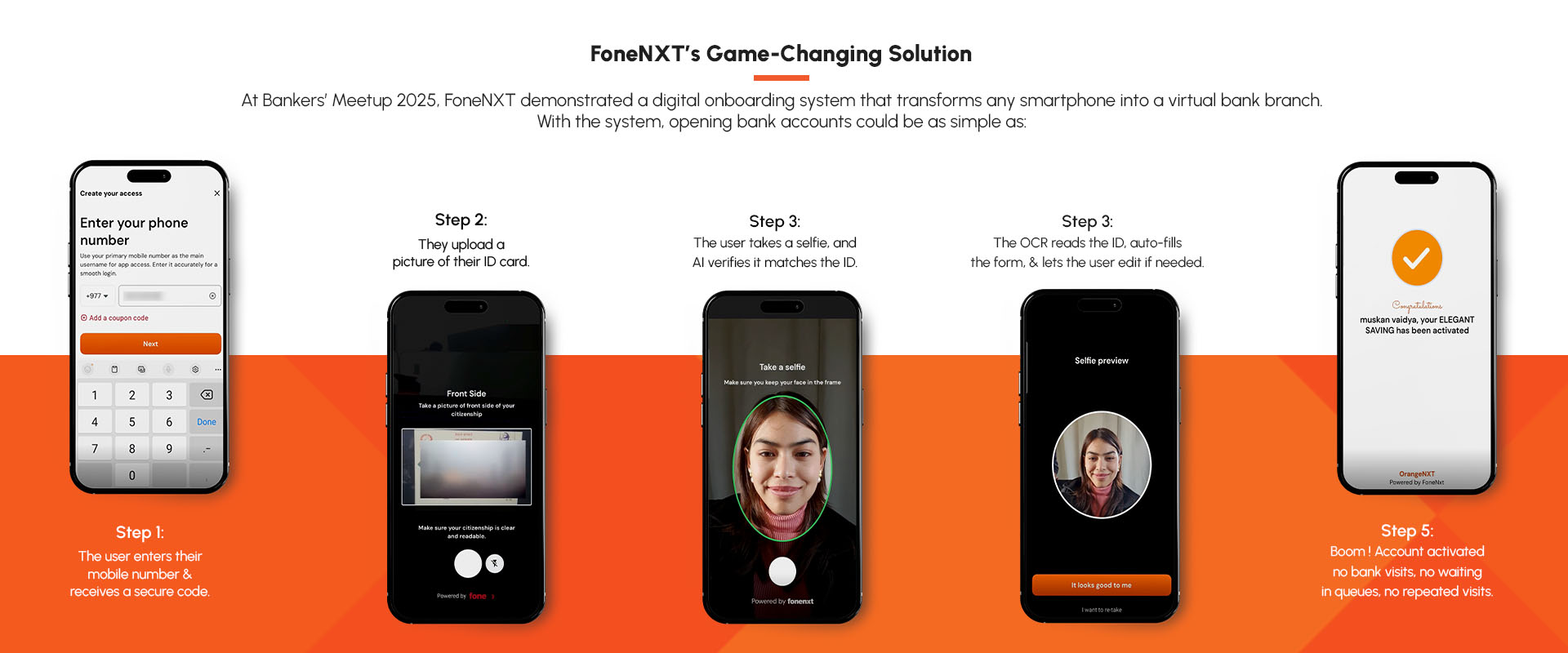

At Bankers’ Meetup 2025, FoneNXT demonstrated a digital onboarding system that transforms any smartphone into a virtual bank branch.

With the system, opening bank accounts could be as simple as:

Why It Matters

The Future is Effortless

By eliminating the barriers of traditional banking, FoneNXT’s digital onboarding system is making financial access as easy as sending a text. It's fast, secure, user-friendly—and ready to bring millions of Nepalis into the formal banking system.

In a world that’s moving fast, FoneNXT ensures that no one is left behind.

Feb 19, 2026

Feb 06, 2026

Nov 24, 2025

Oct 01, 2025