With the theme 'Banking Tomorrow and Beyond', Banker’s Meetup 2025 brought together industry experts and innovators to envision the future of the banking sector. The event featured a series of insightful presentations, among which, Fonepay shared what banking might look like in days to come with Account Aggregator frameworks and Blockchain technology as a way to enhance and simplify financial access in Nepal.

In Nepal, accessing financial services remains a tedious and time-consuming process. Whether it is applying for a loan or opening a bank account, individuals must navigate a web of paper-based formalities - submitting salary slips, tax returns, and identity documents. For many, especially informal workers and micro, small, and medium enterprises (MSMEs), this process is a barrier to financial inclusion. A large portion of the population lacks formal credit histories or collateral, while financial data remains fragmented across multiple institutions.

Despite a rise in digital transactions, much of this financial data is underutilized due to manual processes and privacy concerns. The need for a secure, streamlined, and inclusive financial infrastructure has never been greater.

Enter the Account Aggregator (AA) Framework

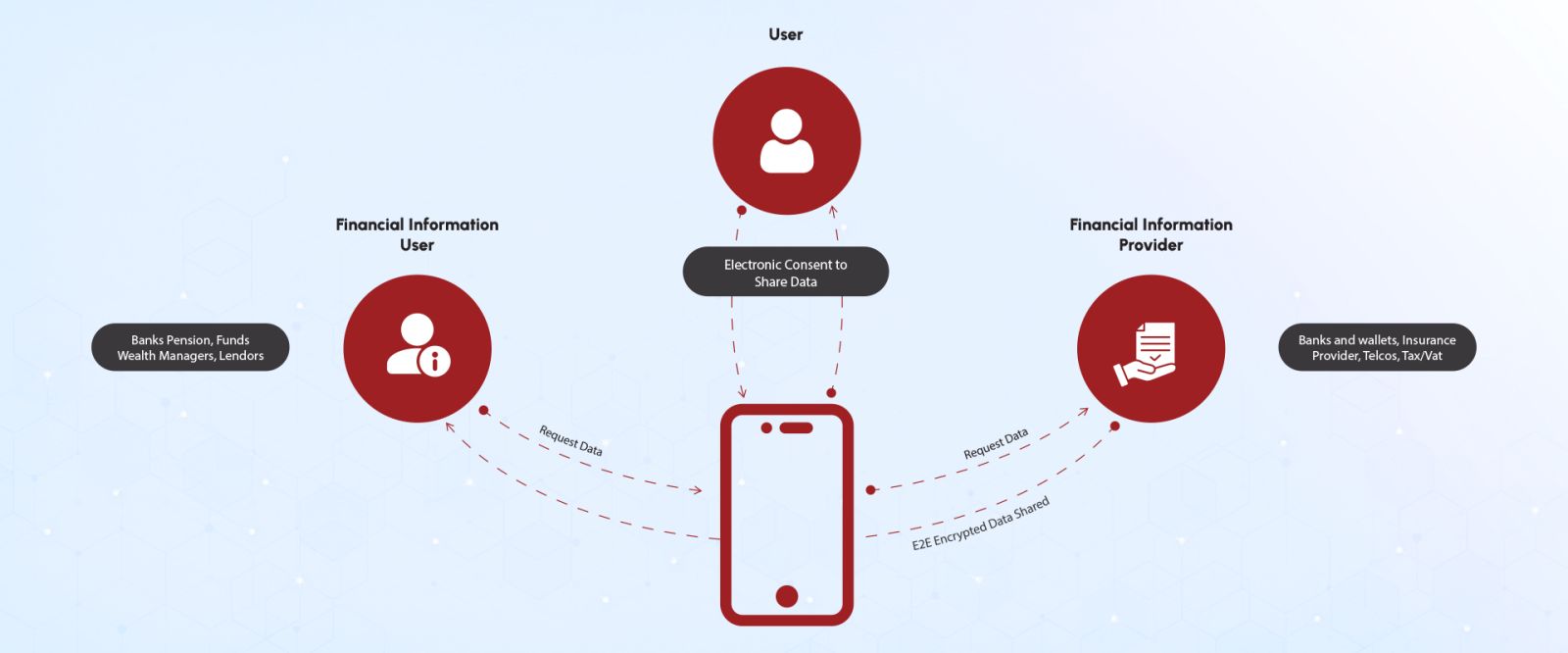

An Account Aggregator is a revolutionary digital platform that acts as a secure, real-time bridge, enabling individuals and businesses to consolidate and share their financial data—from banks, insurance providers, investment firms, and other financial institutions—with their explicit consent. By unifying digital footprints across multiple sources, the AA framework reduces dependency on physical paperwork, enhances data transparency, and accelerates access to financial services such as loans, insurance, and wealth management, all while prioritizing user control and data privacy.

AAs empower users with full control over their data—deciding what to share, with whom, and for how long. Importantly, they do not store any data themselves. With end-to-end encryption and consent-driven sharing, AAs ensure high levels of security and privacy.

Use Cases Across the Financial Ecosystem

Enhancing Trust with Blockchain

Integrating Hyperledger Fabric, a permissioned blockchain, ensures transparency and trust in the AA ecosystem. Every consent and transaction is recorded on an immutable ledger, enhancing data integrity and auditability. Smart contracts automate business logic, while private channels protect sensitive user data. This decentralized, tamper-proof infrastructure is ideal for secure and compliant financial data sharing.

The synergy between Account Aggregators and blockchain technology promises a transformative shift in Nepal’s financial landscape. By enabling secure, real-time, and consent-based data sharing, this framework not only simplifies access to financial services but also promotes financial inclusion, especially for those previously left out of the formal economy.

Feb 19, 2026

Feb 06, 2026

Nov 24, 2025

Oct 01, 2025