Every day, over 1.8 million digital transactions worth more than NPR 17 billion flow seamlessly through Fonepay’s network, a powerful reflection of Nepal’s accelerating shift toward a cashless economy. In today’s fast-evolving digital era, innovation knows no boundaries. The world is rapidly embracing cashless transactions, redefining how people connect, travel, and do business. At the heart of Nepal’s digital revolution stands Fonepay, a pioneer transforming the nation’s financial landscape and leading its journey toward global connectivity. As Nepal’s largest and most trusted payment network, Fonepay is not just promoting financial inclusion, it is shaping the country’s identity as a digitally empowered economy, seamlessly connected to South Asia and beyond.

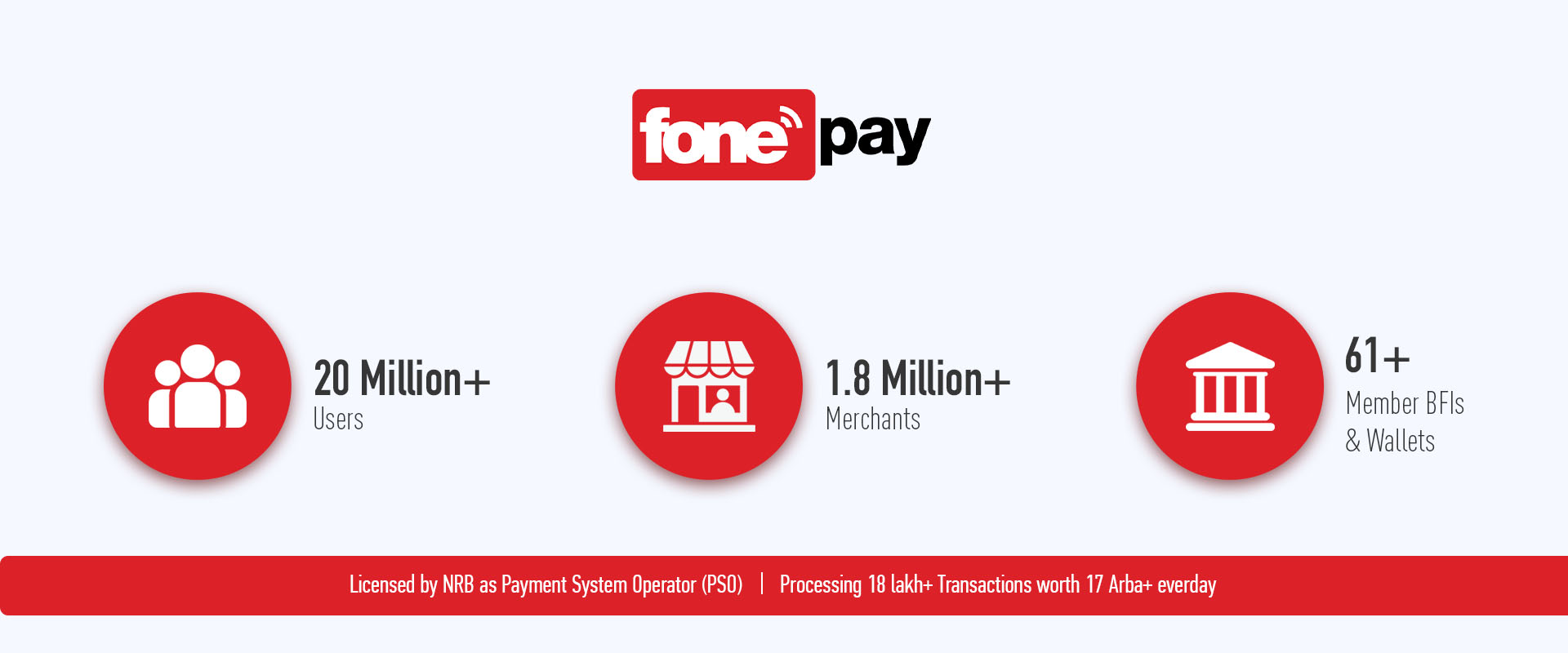

Licensed by Nepal Rastra Bank as a Payment System Operator, Fonepay has established itself as the backbone of Nepal’s cashless ecosystem. It connects more than 20 million users and over 1.8 million merchants, supported by 61+ member banks, financial institutions, and digital wallets. This extensive network processes over 1.8 million transactions daily, amounting to more than NPR 17 billion, a remarkable reflection of Nepal’s growing trust in digital transactions. Fonepay’s success is not just about numbers; it represents the nation’s collective shift toward convenience, transparency, and security.

Why Cross-Border Payments Matter

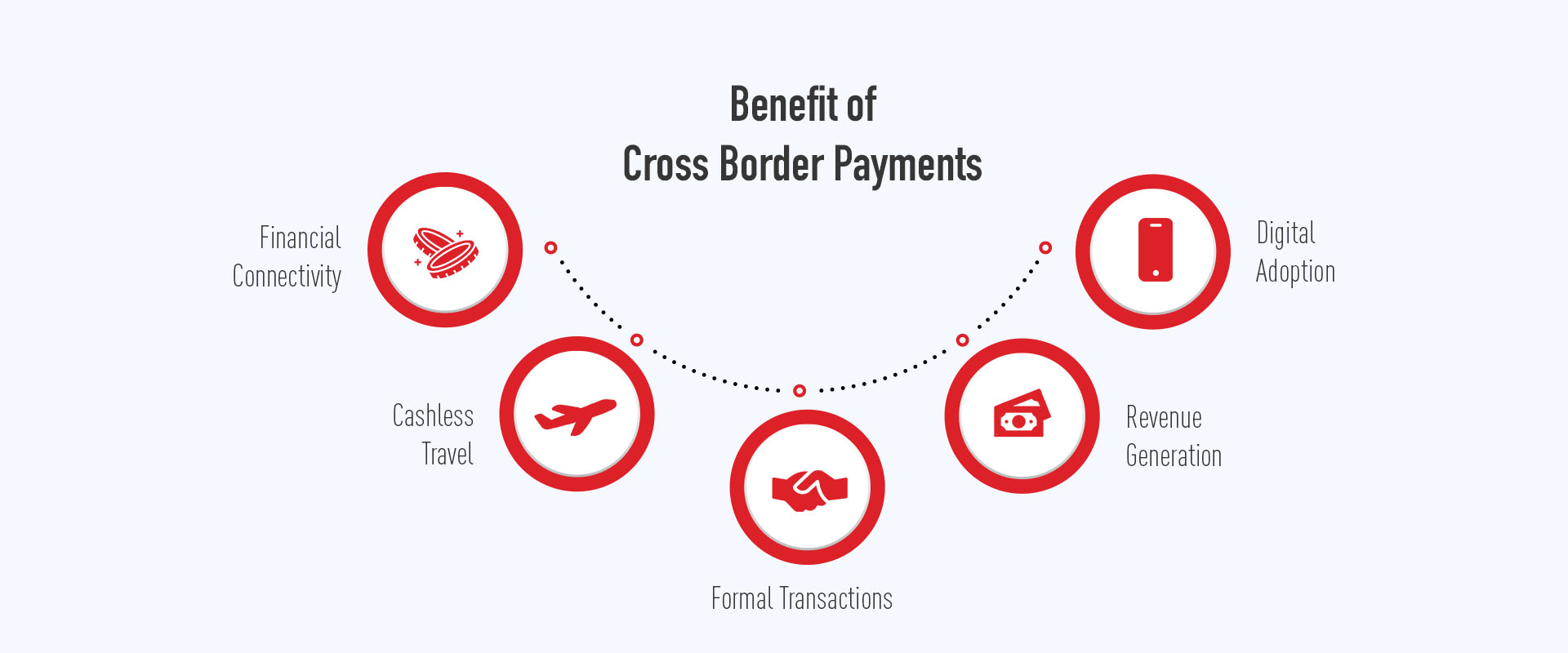

As part of the Digital Nepal Framework, these systems play a vital role in boosting tourism, trade, and international partnerships. For travelers, cross-border payments mean they can explore Nepal without worrying about currency exchange hassles. For local businesses, it means new opportunities, access to international customers, increased visibility, and efficient transactions. Imagine being able to make, and receive payments as if businesses were not dealing with different currencies across borders.

Beyond the convenience factor, cross-border payments bring a new level of transparency. Every transaction is secure, traceable, and compliant with regulatory standards. This promotes accountability and helps in combating financial crimes such as money laundering or fraudulent transfers, thereby strengthening Nepal’s overall financial integrity.

Cross-Border Collaborations Driving Nepal’s Digital Transformation

Fonepay is the ideal platform for a cross-border fintech solution given its spirit of collaboration and innovation. One of its most significant achievements is the integration with the National Payments Corporation of India through the Fonepay-UPI partnership. This initiative has revolutionized digital transactions between Nepal and India, two countries deeply connected through culture, tourism, and trade. Now, Indian tourists visiting Nepal can easily make payments at local merchants using UPI-enabled apps, while Nepali merchants benefit from faster settlements, improved liquidity, and greater exposure to the Indian market.

Fonepay’s partnerships extend even further through its collaboration with Alipay+, a global digital payment network. This partnership has unlocked Nepal’s tourism potential by allowing visitors from countries such as China, Korea, Malaysia, Thailand, Philippines, and Singapore to make payments directly through Fonepay QR codes. This simple, cashless system eliminates the stress of currency exchange, making Nepal a more attractive destination for international travelers and boosting local business revenues.

A Secure and Compliant System

As financial transactions move increasingly online, security is a high priority. Fonepay operates under a robust risk management and regulatory framework, strictly adhering to NRB’s guidelines on anti-money laundering (AML/CFT), transaction monitoring, and data protection. Every payment made through Fonepay is safeguarded by state-of-the-art encryption technologies, L3 VPN connectivity, and certifications such as ISO 27001:2022 and PCI-DSS.

Moreover, continuous monitoring through advanced Security Operations Centers (SOC) and incident response systems ensures that threats are detected and mitigated in real time. These measures not only maintain trust among users and merchants but also position Fonepay as a reliable digital payment leader committed to the highest international standards of safety.

Empowering Businesses and Tourists Alike

From the bustling streets of Kathmandu, Pokhara and Chitwan to the serene pilgrimage sites of Pashupatinath Temple, Muktinath, and Manakamana, Fonepay QR codes have become a familiar sight. Nearly every local business - from restaurants, hotels, travel agencies to grocery stores and even hospitals are equipped to accept digital payments from both domestic and international visitors. This not only enhances the travel experience for tourists but also empowers local entrepreneurs to expand their customer base beyond borders.

For merchants, Fonepay’s ecosystem offers far more than just payment collection. It provides easy onboarding processes, transparent settlement systems, and comprehensive dispute management support, ensuring that every business—big or small—feels secure and supported. This inclusive digital ecosystem has given local merchants a new level of confidence and stability in managing their finances digitally.

Unlocking New Possibilities in Global Finance Through Cross-Border Payments

Cross-border payments represent the next frontier in global finance, bridging economies and connecting lives. They empower nations like Nepal to participate more actively in international trade, tourism, and investment while ensuring that transactions remain transparent and secure. As Fonepay expands their global reach, they unlock unprecedented opportunities for collaboration and economic growth. The ability to receive money instantly, regardless of geography, strengthens financial inclusion and paves the way for a future where digital payments transcend boundaries. In this new era of interconnected economies, Fonepay stands as a beacon of innovation, unlocking new possibilities in global finance, one payment at a time.