As smartphones replace wallets and QR codes replace cash, Nepal is changing how it thinks about money. While digital payments have taken off, until recently, credit access hadn’t kept pace with the country's digital momentum. This is where Virtual Credit Cards (VCCs) step in. They’re not just a convenience, but also a bridge to financial inclusion for a new, mobile-first generation.

Across the globe, virtual credit cards are enabling safer and smarter financial choices. VCCs are designed for the digital age. They’re easy to activate, don’t require a physical card, and can be made instantly available through mobile banking apps. They open doors for those who are new to credit, especially younger, mobile-first users who are already comfortable with digital tools.

For example, in India, fintech platforms like Paytm and ICICI Bank offer instant virtual credit cards to new users, expanding credit access even in semi-urban regions. Similarly, in the USA, Capital One’s Eno virtual credit card allows users to generate a unique virtual card number for each e-commerce transaction, helping protect their real credit card details from potential exposure or misuse. These global examples show that virtual credit cards are no longer just a new idea. They are now becoming a regular and important part of how people use credit today.

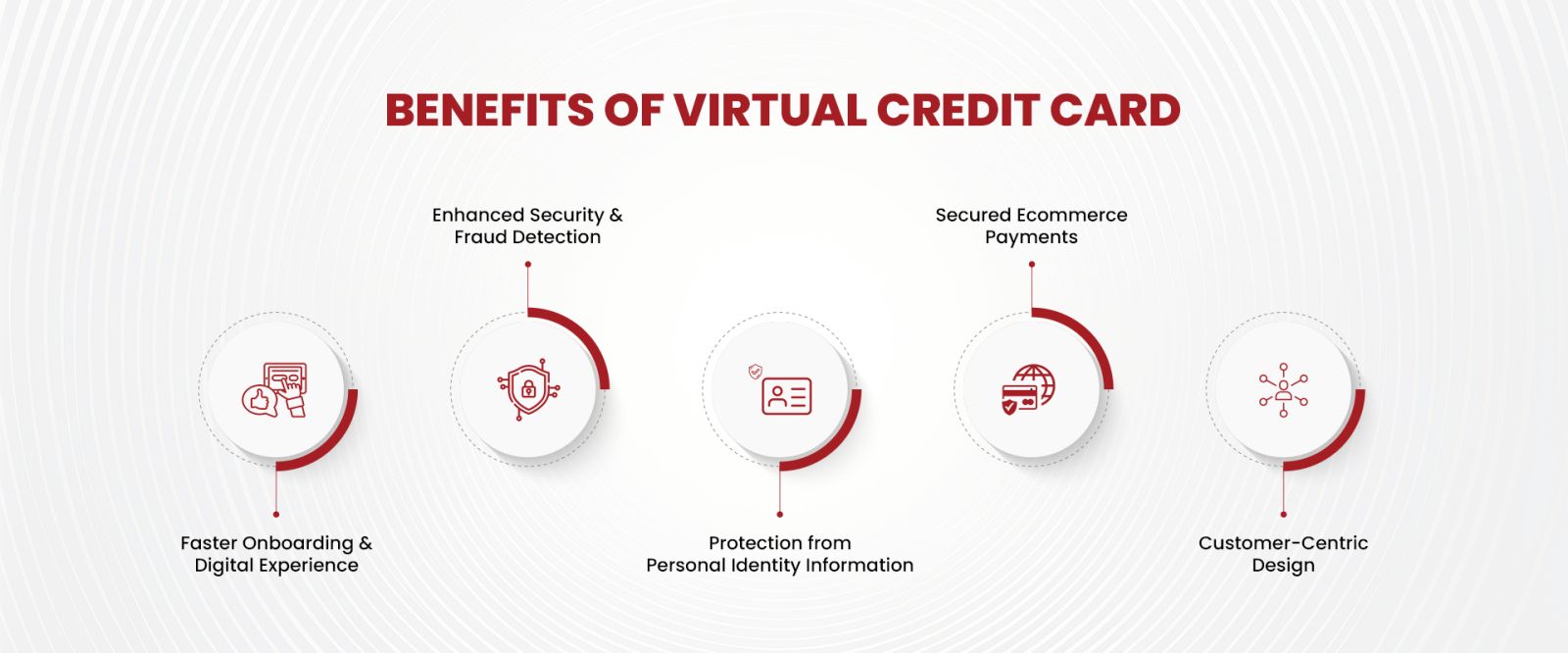

Why Virtual Credit Cards Are Game-Changers for Credit Access

Getting access to credit has never been easy for everyone, especially for those without a steady income or credit history. Virtual credit cards are changing that by making credit more flexible, safer, and easier to access right from your phone. Here’s how virtual credit cards are breaking barriers and reshaping the way people access credit.

1. Faster Onboarding and Digital Experience

Virtual credit cards make the onboarding process faster and more convenient than traditional credit systems. There's no need to visit a bank or fill out lengthy paperwork. Everything happens digitally. Compared to the traditional credit card application process that can take days or weeks, VCCs offer instant activation and access, aligned with modern user expectations. This quick and simple experience not only saves time but also makes access to credit more approachable for people who are new to formal financial services.

2. Inclusive Credit for the Unbanked and Underbanked

A large portion of Nepal’s population remains outside the formal credit system, either due to lack of documentation, irregular income, or limited access to traditional banking services. Virtual credit cards remove these barriers by offering credit through digital onboarding, often using alternative data like digital transactions and behavioral analytics for approval. This unlocks financial inclusion for students, freelancers, SMEs, and gig workers who are often denied traditional credit.

3. Enhanced Security and Fraud Protection

Online scams and payment frauds are on the rise. Virtual cards offer temporary card numbers, CVV codes, and customizable spending limits, giving users control and peace of mind. Some platforms even auto-expire VCCs after a single use or specified time, making them virtually useless to hackers or cybercriminals.

4. Secure eCommerce Payments

Virtual credit cards offer a safer way to make payments online. By using a unique card number for each transaction, they help protect your actual card details from being exposed. (Source: JP Morgan) This simple layer of security can go a long way in reducing the risk of fraud, allowing you to shop on eCommerce platforms with greater peace of mind. With limited validity and spending control, virtual cards help users shop confidently on eCommerce platforms without exposing their real card details.

Fonepay Credit Card: Nepal’s First Virtual Credit Card

With digital payment systems evolving globally, Nepal has also taken a meaningful step forward with the launch of the Fonepay Credit Card - Nepal’s first virtual credit card. It’s a digital version of the traditional credit card, designed to make credit access easier, faster, and more secure. Issued instantly through mobile banking apps, it removes the long wait and paperwork often associated with physical cards.

Built on Fonepay’s QR ecosystem, it works across a wide network of over 1.7 million merchants. What makes it even more user-friendly is the control it offers—users can set their billing cycle, track spending, and choose when and how they repay. With up to 45 days of interest-free credit and flexible repayment options, Fonepay Credit Card opens up a more convenient and empowering way for people to manage their finances digitally.

The introduction of Fonepay Credit Card marks a thoughtful step toward making credit more accessible and manageable for everyday users in Nepal. By combining the ease of mobile banking with the flexibility of credit, it offers a practical solution for those looking for a safer, faster, and more convenient way to pay. As more people embrace digital tools in their daily lives, solutions like this can help build a more inclusive and empowered financial future.