Artificial Intelligence is one of the most powerful tools shaping today’s business world. From self-driving cars to smart home devices, AI has found its place in nearly every industry. AI is no longer just a trend, it’s a part of everyday life. Users expect chatbots to give quick answers and understand their needs even before they say them clearly. Today, more than 75% of people use AI for navigation, 70% rely on virtual assistants, and over 250 million people used AI tools in 2023.

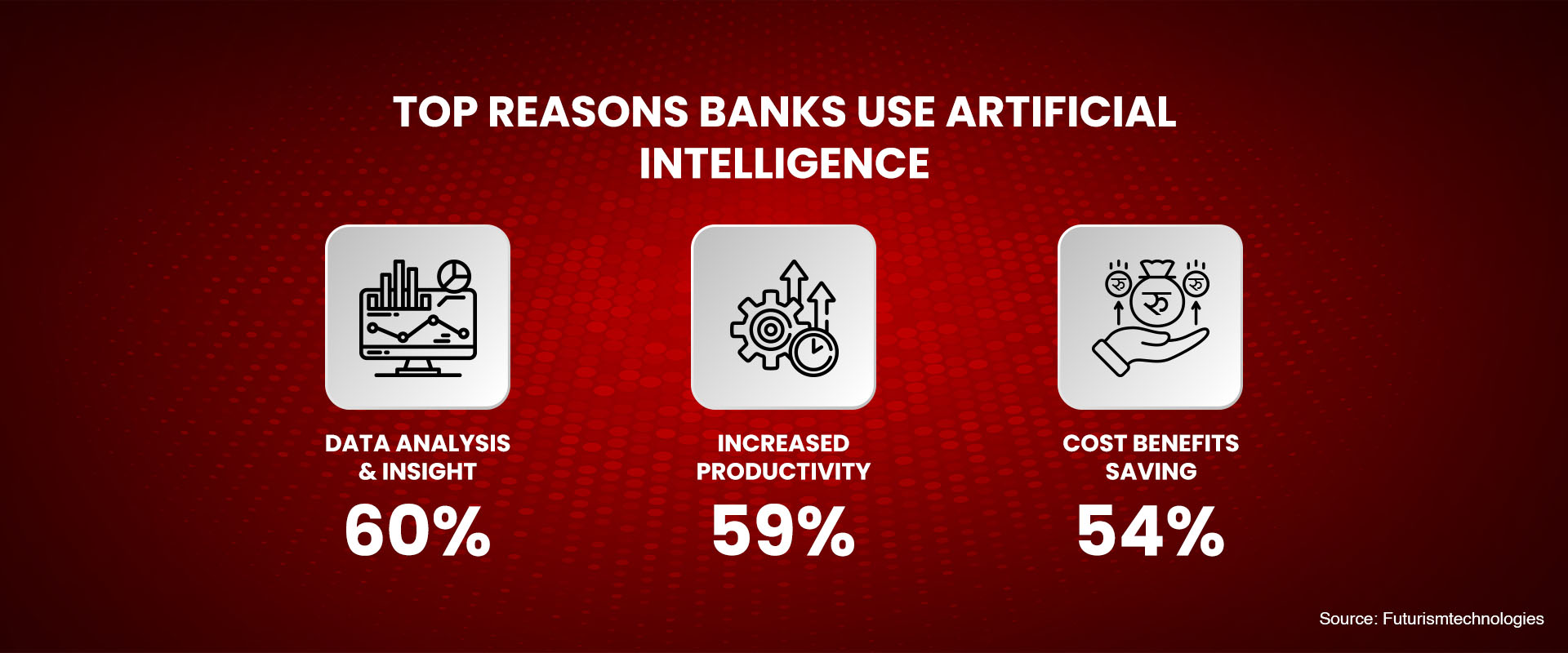

Since its emergence, AI has had a profound transformative effect, reshaping how businesses operate and serve their customers. In the banking sector, AI is redefining how BFIs serve customers, manage risks, and compete in an increasingly digital economy. Nearly 80% of bankers claim to be aware of the potential of AI in banking (according to Business Insider), with McKinsey noting that AI could add as much as $1 trillion in value to the industry. CITY GPS doubles that claim, projecting an upscale in profits up to $2 trillion by 2028.

Global Trend of AI in Banking

Leading institutions use AI for automating routine processes, strengthening security, and improving decision-making. For instance, many banks now rely on AI systems to scan and process large volumes of legal documents and contracts much faster than manual reviews. Fraud detection has become more efficient as AI monitors transactions in real time, instantly identifying unusual patterns and blocking suspicious activities before they cause damage. Virtual assistants powered by AI handle customer queries around the clock, helping people check account details, pay bills, and receive financial advice without waiting in line or on hold. These examples hint at how AI has moved from an experimental tool to an essential part of banking operations.

Application of AI in Banking & Finance

AI has rapidly become an integral part of the modern banking landscape. Banks and financial institutions across the globe are actively embracing AI technologies to enhance their products, services, and overall operational efficiency. Below are some of the key applications of AI that are shaping the future of the banking industry.

Risk Management and Fraud Prevention

Several digital transactions occur daily as users pay bills, transfer funds, and more through mobile and internet banking solutions. But with an increase in accessibility, there’s also a risk of malicious activity.

The huge data processing capabilities of AI enables banks to effectively monitor fraudulent activities, identify vulnerabilities within their systems, mitigate risks, and significantly enhance the overall security of online financial transactions. Danske Bank, Denmark makes a case for such an implementation. By implementing an advanced fraud detection algorithm powered by deep learning, the bank has significantly strengthened its ability to identify fraudulent activities, achieving a 50% improvement in detection rates and a 60% reduction in false positives.

Likewise, researchers at JPMorgan Chase have developed an advanced early warning system that employs artificial intelligence and deep learning techniques to detect malware, trojans, and phishing campaigns. According to their research, it would approximately take 101 days for a trojan to infiltrate and compromise a company’s network. This proactive system provides critical advance notice of potential attacks and automatically alerts the bank’s cybersecurity team as soon as hackers begin preparing to distribute malicious emails.

Chatbot

Chatbots are among the most effective and practical use cases for AI. Unlike human employees, chatbots are available 24/7, ensuring that customers receive assistance whenever they need it, without any delays. By integrating chatbots, banks can provide continuous support and improve customer satisfaction.

A notable example is Erica, the virtual assistant introduced by Bank of America. Erica helps customers manage credit card debt, update card security settings, and much more. In 2019 alone, Erica successfully handled over 50 million client requests, highlighting the significant impact of AI-driven chatbots in the banking sector.

eSewa’s virtual assistant, eVA, is the country’s first AI-powered chatbot capable of handling complex tasks, such as processing payments based on user instructions.

Loan and Credit Decision

In 2019, Upstart, a U.S.-based lending platform, became one of the first companies to use AI technology in its credit decision process. Unlike traditional lenders, Upstart uses machine learning to analyze over 1,000 data points—including education, job history, and spending behavior—to determine a borrower's creditworthiness. This helped them approve more loans with lower default rates, especially for younger people with limited credit history.

AI-based systems to make more informed, safer, and profitable loan and credit decisions. While traditional methods only rely heavily on credit scores and customer references, they can often contain errors and overlook crucial transaction details. AI overcomes these limitations by analyzing customer behavior and spending patterns, even for those with limited credit history, to assess creditworthiness more accurately.

Customer Experience

The integration of AI in banking and finance services further enhances the consumer experience and increases the level of convenience for users. Many banks across Europe have deployed AI chatbots to handle millions of customer interactions each year, reducing service costs by up to 30%. Apart from commercial banks, several investment banks, such as Goldman Sachs and Merrill Lynch, have also integrated artificial intelligence in banking operations.

Merrill Lynch have used AI tools to give clients smart investment advice based on real-time data. In addition, numerous banks have adopted AlphaSense, an AI-powered search engine that leverages natural language processing to identify market trends and conduct sophisticated keyword analysis. Moreover, AI-driven customer service ensures that client information is captured accurately, reducing mistakes and enhancing satisfaction.

Opportunities of AI in the Banking Sector in Nepal

As AI is changing the way people do with their banking globally, it also holds immense opportunities for transforming the banking sector in Nepal. By implementing AI, the banking sector in Nepal can gain significant benefits. Around 66% of the adult population now uses digital banking (internet & mobile banking) over visiting branches. Thus, the integration of AI can help banks deliver fast, customized, and secure services through mobile and online channels.

As per Nepal's Cyber Bureau, cybercrime cases nearly doubled from 9,013 in fiscal year 2022-23 to 19,730 in 2023-24. Implementing AI in banking platforms can significantly help combat this surge in fraud and cybercrime in Nepal's expanding digital market. The AI technology can analyze vast amounts of transaction data in real-time to detect unusual patterns and anomalies that might indicate fraudulent activity, often catching it before it even occurs.

Moreover, AI can be a game-changer for financial inclusion, especially in Nepal's diverse and often geographically challenging terrain. Many people in rural and remote areas have limited access to physical bank branches because of the country’s challenging geography. Thus, AI can bridge this gap by offering banking services through digital tools like mobile apps, chatbots, and virtual assistants. AI can also understand and respond in local languages and dialects, which is very important in Nepal’s diverse linguistic landscape.

AI has already transformed global banking and holds huge promise for Nepal’s financial sector. As digital adoption grows, AI will become more accessible and affordable. While there are huge challenges ahead, to succeed with this, the banking industry in Nepal must strengthen data security, and collaborate with regulators to build trust and compliance. In the coming years, AI will not replace human bankers but will empower them to work smarter and serve customers better. By embracing AI thoughtfully, Nepalese banks can build a stronger, safer, and more inclusive financial system for the future.